Modern awards

Modern Awards set out minimum standards and conditions for employees who perform a specific type of work, regardless of which industry they work in.

Some Awards may apply across an industry, such as the Building and Construction General On-site Award 2020. It’s also possible that an employee performs work that is covered under multiple Awards.

Flexible terms

Some Modern Awards contain flexibility terms, which enable employers and employees to negotiate changes to various standards and conditions.

A Modern Award can only be changed if it:

- Is agreed to by both the employer and employee

- Isn't below the conditions of the Award

- Ensures the employee is better off under the change.

If you need help identifying the appropriate Award for a worker or would like to access a flexibility agreement template, contact Master Builders’ Workplace relations team.

Wages

All businesses must observe the pay and conditions set out in Modern Awards.

We’ve produced handy wage circulars exclusively for Master Builders members, which summarise important payment information contained within each Award.

You can use your member login to access and download our wage circulars.

You can also view Modern Awards on the Fair Work Commission website.

Apprentices

Most Queensland apprentices are entitled to pay rates and conditions covered under a relevant Modern Award or enterprise agreement. Adult apprentices (aged 21 or over when they begin their apprenticeship) and school-based apprentices are subject to different pay rates and conditions.

Some Queensland apprentices were previously engaged under special Queensland regulations with wages less than the Modern Award, but this ended on 31 December 2013.

Back pay claims

Queensland apprentices engaged under the Queensland regulations may have been underpaid due to errors by the Fair Work Ombudsman. The underpayments may extend back to 1 January 2014.

The federal Attorney-General's Department has confirmed that the federal government will compensate employers who have made back pay to apprentices, arising from the errors of the Fair Work Ombudsman. More information.

Master Builders has historical award wages information available for members to calculate if they have an obligation to adjust back pay. Our team of experts are on hand to assist members with any information or explanation for your apprentices.

If you need help working out which pay rate or conditions apply to your apprentice, contact Master Builders’ Workplace Relations team.

Inclement weather calendar

An employee is entitled to be paid for up to 32 hours of work lost due to inclement weather (rain or abnormal climatic conditions) in every four week period, under the Building and Construction General On-site Award 2010. The periods don’t necessarily start on the first day and end on the last day of each month.

Employees are credited with 32 hours at the beginning of each period, including new employees who start work during the first week of any period. The number of credited hours can’t exceed 32, and unused credits don’t accrue.

If a new employee starts in the second week of the period they'll be credited with 24 hours. If they start in the third week they'll be credited with 16 hours, and if in the fourth week with eight hours.

We've produced an inclement & wet weather wages calendar for members to help determine whether an employee has credits towards payment for ordinary working time lost due to inclement weather. You can use your member login to access and download the calendar.

Need more information?

If you haven’t found the answer to your questions give us a call on 1300 30 50 10 or email us.

Travel

Building and Construction General On-site Award 2020

Employees in the building and construction industry often move between different job sites. Because of this, the Building and Construction General On-site Award 2020 provides specific allowances to compensate employees for additional travel and the change in work locations.

Frequently asked questions

Fares and travel pattern allowance

What is the daily fares and travel allowance?

The daily fares and travel allowance is an amount payable under the Building and Construction General On-site Award 2020 (the Award) to compensate employees for the cost and inconvenience of travelling to different construction sites.

It recognises that employees in the industry regularly move between job sites rather than having a fixed workplace. The allowance is paid for each day the employee attends a construction site using their own transport.

When are employees entitled to the daily fares and travel allowance?

Employees are entitled to this allowance if they:

- Start work on a construction site, and

- Use their own means of transportation to get there.

How much are the daily fares and travel allowance?

Is the allowance payable if a company vehicle or transport to site is provided?

No. If the employer provides transport to and from the site (for example, a company vehicle, or carpool arranged by the company), the employee is not entitled to the daily fares and travel allowance.

This is because the allowance is only payable when the employee uses their own means of transport to travel directly to the construction site.

Is the allowance payable if the employee is required to start at the office/factory, then travel to site?

No. If an employee is required to report first to the company’s depot, office, or workshop and then travel to the site during work hours, they are not entitled to the daily fares and travel allowance.

In this case, travel between the office/factory and the site forms part of their paid working time, not an allowance.

Do the fares and travel allowance count towards superannuation?

The daily fares and travel allowance is superable, because it is paid in connection with the employee’s ordinary hours of work and therefore counts as ordinary time earnings (OTE) for superannuation purposes.

Distant travel allowances (e.g., $0.59 per km if using their own vehicle to travel to a distant site, or $0.98 per km for travel between sites) are reimbursement-type allowances for expenses and are not superable, as they are not considered part of OTE.

Is the allowance taxable?

Yes. The allowance is generally taxable under ATO rules, as it is a travel allowance paid for work-related travel.

Employees may be able to claim a deduction for actual work-related travel expenses incurred, subject to ATO substantiation requirements.

Distant work payment

When I require my employees to travel to a distant worksite, can I start paying them travel from the 50km radius?

No. The 50km radius is used to determine whether an employee qualifies for distant work payments or the daily fares and travel allowance.

Once an employee meets the entitlement for distant work payments, their starting point is their home address, not the 50km radius point.

When is an employee entitled to distant work payments?

An employee is entitled to distant work payments if they meet both of the following:

- The worksite is more than 50km from the GPO (in a capital city) or principal post office (in a regional town/city); and

- The worksite is more than 50km from their residential address.

If both conditions are met, the employee will not receive the daily fares and travel allowance, they will instead receive distant work payments.

Examples

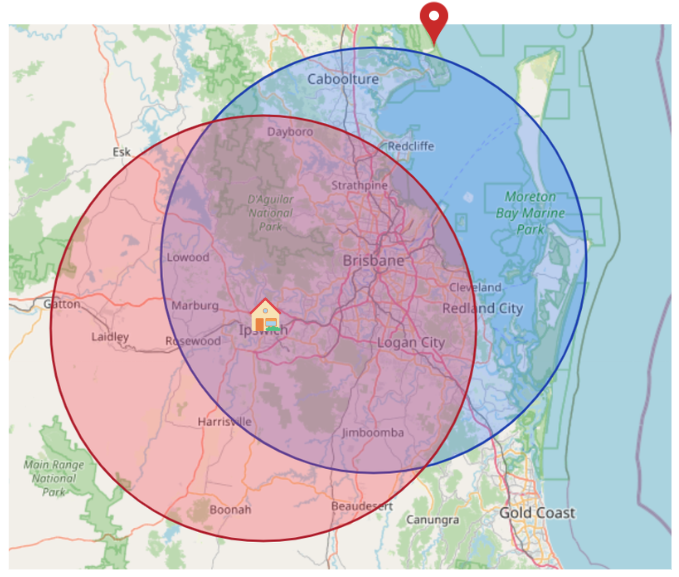

Daily fares and travel allowance applies

- Employee: Resides in Ipswich

- Job site: Caboolture

Result: Employee only satisfies one requirement (outside 50km from home but not 50km from GPO).

Employee receives daily fares and travel allowance.

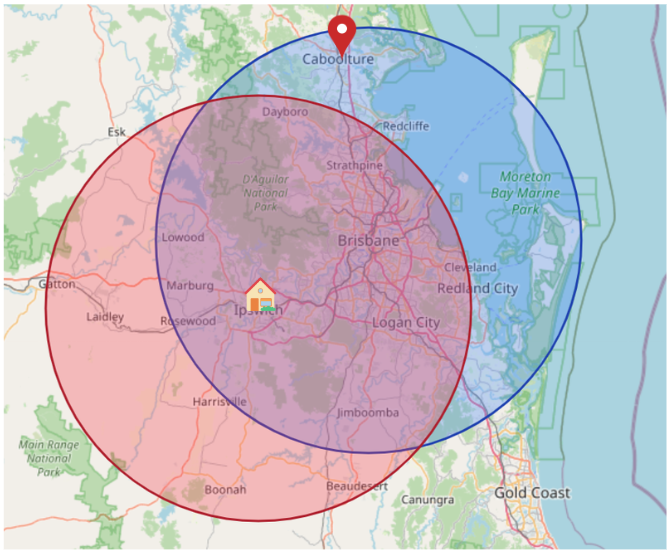

Distant work payment applies

- Employee: Resides in Ipswich

- Job site: Bribie Island

Result: Employee satisfies both requirements (outside 50km from GPO and from home).

Employee receives distant work payment.